Hudson company reports the following contribution margin income statement – The Hudson Company’s Contribution Margin Income Statement is a powerful financial tool that provides valuable insights into the company’s profitability and operational efficiency. This statement segregates revenues and expenses based on their behavior with changes in activity levels, enabling a deeper understanding of the relationship between costs, volume, and profit.

By examining the contribution margin income statement, stakeholders can assess the company’s ability to generate profits, identify areas for cost optimization, and make informed decisions regarding pricing strategies and production levels.

Contribution Margin Income Statement

A contribution margin income statement is a financial statement that shows the contribution margin of a company, which is the difference between sales revenue and variable costs. The contribution margin is an important metric for companies because it shows how much of each sales dollar is available to cover fixed costs and contribute to profit.

The purpose of a contribution margin income statement is to provide management with information about the company’s profitability. The statement can be used to identify areas where the company can improve its profitability, such as by increasing sales revenue or decreasing variable costs.

The contribution margin income statement has several limitations. One limitation is that it does not take into account fixed costs. This means that the statement can be misleading if the company has a high level of fixed costs.

Key Components of the Contribution Margin Income Statement

The key components of the contribution margin income statement are:

- Sales revenue

- Variable costs

- Contribution margin

- Fixed costs

- Net income

Sales revenue is the total amount of revenue generated by the company from the sale of its products or services.

Variable costs are the costs that vary with the level of production. These costs include raw materials, direct labor, and variable overhead costs.

Contribution margin is the difference between sales revenue and variable costs. The contribution margin is an important metric for companies because it shows how much of each sales dollar is available to cover fixed costs and contribute to profit.

Fixed costs are the costs that do not vary with the level of production. These costs include rent, depreciation, and administrative salaries.

Net income is the difference between sales revenue and total costs (variable costs plus fixed costs).

Contribution Margin Ratio: Hudson Company Reports The Following Contribution Margin Income Statement

The contribution margin ratio is a measure of the company’s profitability. The ratio is calculated by dividing the contribution margin by sales revenue.

Contribution Margin Ratio = Contribution Margin / Sales Revenue

A high contribution margin ratio indicates that the company is generating a lot of profit for each dollar of sales revenue. A low contribution margin ratio indicates that the company is not generating enough profit to cover its fixed costs.

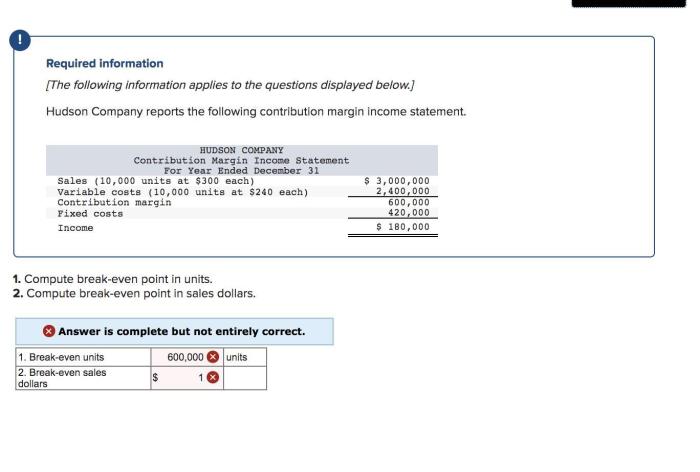

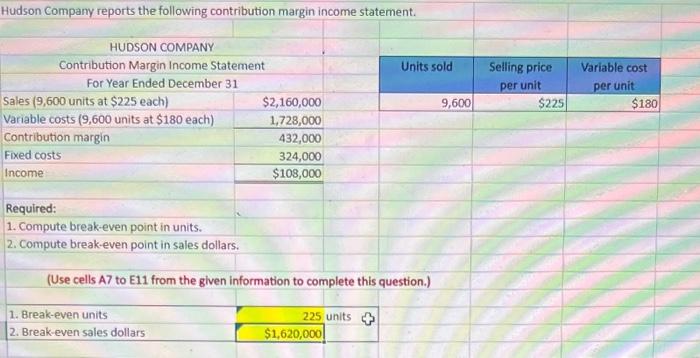

Break-Even Point

The break-even point is the level of sales revenue at which the company’s total costs equal its total revenue. At the break-even point, the company is not making a profit or a loss.

The break-even point can be calculated using the following formula:

Break-Even Point = Fixed Costs / Contribution Margin Ratio

A high break-even point indicates that the company needs to generate a lot of sales revenue to cover its fixed costs. A low break-even point indicates that the company can generate a profit even with a low level of sales revenue.

Margin of Safety

The margin of safety is the difference between the company’s actual sales revenue and its break-even point. The margin of safety is an important metric for companies because it shows how much the company can afford to decrease sales revenue before it starts to lose money.

The margin of safety can be calculated using the following formula:

Margin of Safety = Actual Sales Revenue

Break-Even Point

A high margin of safety indicates that the company has a lot of room to decrease sales revenue before it starts to lose money. A low margin of safety indicates that the company does not have much room to decrease sales revenue before it starts to lose money.

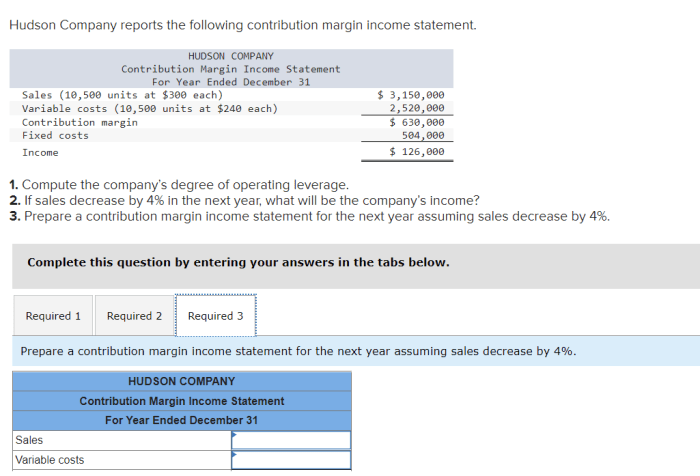

Cost-Volume-Profit (CVP) Analysis

CVP analysis is a technique that is used to analyze the relationship between costs, volume, and profit. CVP analysis can be used to:

- Calculate the break-even point

- Determine the impact of changes in sales revenue on profit

- Determine the impact of changes in costs on profit

CVP analysis is a powerful tool that can be used to improve the profitability of a company.

FAQs

What is the purpose of a contribution margin income statement?

A contribution margin income statement separates revenues and expenses based on their behavior with changes in activity levels, providing insights into the relationship between costs, volume, and profit.

How is the contribution margin ratio calculated?

The contribution margin ratio is calculated by dividing the contribution margin by the sales revenue.

What is the significance of the break-even point?

The break-even point is the level of sales at which the company neither makes a profit nor incurs a loss.